Buying a house out of the state is a tricky territory where you need to tread carefully. Whether you plan to buy from a company that says ‘we buy houses and sell them fast’ or plan to buy directly from a property owner, you should plan well. You should also be ready to overcome obstacles as you’ll be moving out of state. However, it’s not a Herculean task since you’ll just need some additional strategies and tips to sail through the process.

Here are the chief things to consider when planning to buy a house that’s located out of state:

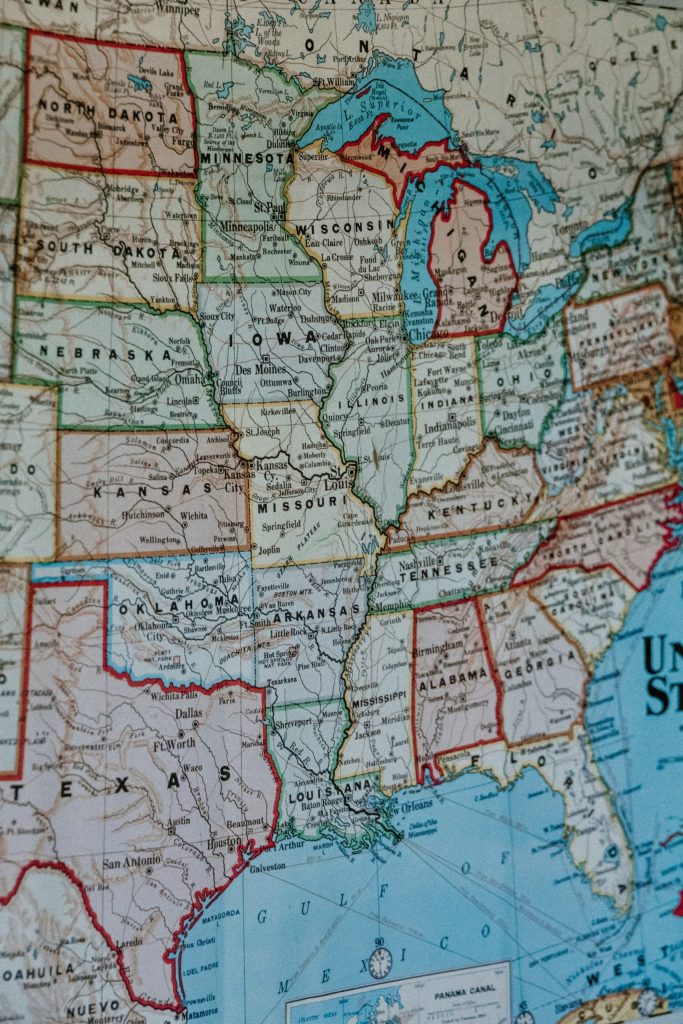

1. Research the Neighborhood and Find the Cost Of Living

To get a sense of what a neighborhood would feel like, you should research different suburban areas of your choice and focus on other relevant factors like crime rates, the proximity to schools, grocery stores, your workplace, etc. Apart from evaluating the amenities on offer, you should also consider the cost of living. For instance, even when a neighborhood is extremely popular, its steep cost of living could deter you from buying a house there. What you can do instead is to search for areas nearby that are affordable and yet let you stay close to the popular area.

2. Hire a local Real Estate Agent

Since a local realtor knows the area well, has his own professional networks and connections to leverage, and is aware of the local market trends, he would be able to find you a suitable home quickly. Be it finding companies that say ‘we buy houses and sell them quickly for cash’ or finding direct property sellers, such an agent can make your search easier. You just need to ensure your chosen real estate agent is reliable, understands your preferences, and keeps the communication channels open. Be it finding you appropriate listings, arranging a virtual property tour, or negotiating the deal on your behalf, a dependable local realtor will do all these and more to get you your money’s worth.

3. Ensure To Have a Pre-Approved Mortgage

To pre-approve a mortgage, your prospective mortgage lenders will inspect your finances and credit report to decide the amount they’ll lend to you, the rate of interest, and the terms. Before seeking a mortgage, you should have a clear picture of your finances and consider elements like the down payment and closing costs to decide what would be an affordable price for you. Though a mortgage lender will let you know about the costs involved and explain the mortgage process in detail, having clarity about your finances would let you make an informed decision about what the right choice is for you.

4. Jot Down a Move-In Checklist

Your checklist could have tasks like making travel arrangements, renting a moving truck, packing and labeling boxes, updating your address, transferring the utilities, etc. The goal is to keep an eye on everything you need for a seamless move while ensuring nothing is left behind or forgotten.

5. Be Ready To Weather the Storm

Despite planning everything to the minutest of details, unexpected events could happen, raising unexpected costs to bear. For example, bad weather, transportation problems, road accidents, etc. can delay the move or add costs to what you had earlier budgeted for. Thus, it pays to set aside an emergency fund to meet such sudden expenses, like repairing the damaged good, staying at a hotel until your furniture arrives, etc. You should also keep your essential documents, a few clothes, and medicines with you to ensure even if your things arrive late, you don’t face any problems.

Thus, with some research, diligent planning, and proper execution, buying an out-of-state house would no longer be the dreaded distant dream.